RESEARCH

We are constantly researching new ways to understand asset time series and derivatives pricing

INVESTMENT

We invest in US equities and options, aiming to beat the market while hedging against crashes and corrections

TOOLS

Professional Level Investment tools for managing portfolio risk and optimising returns

DEVELOPMENT

We develop our code in house, using proprietary models

TOOLS

Professional Level Investment tools for managing portfolio risk and optimising returns

OPTION PRICING

Black-Scholes and alternative pricing models for option price comparisons

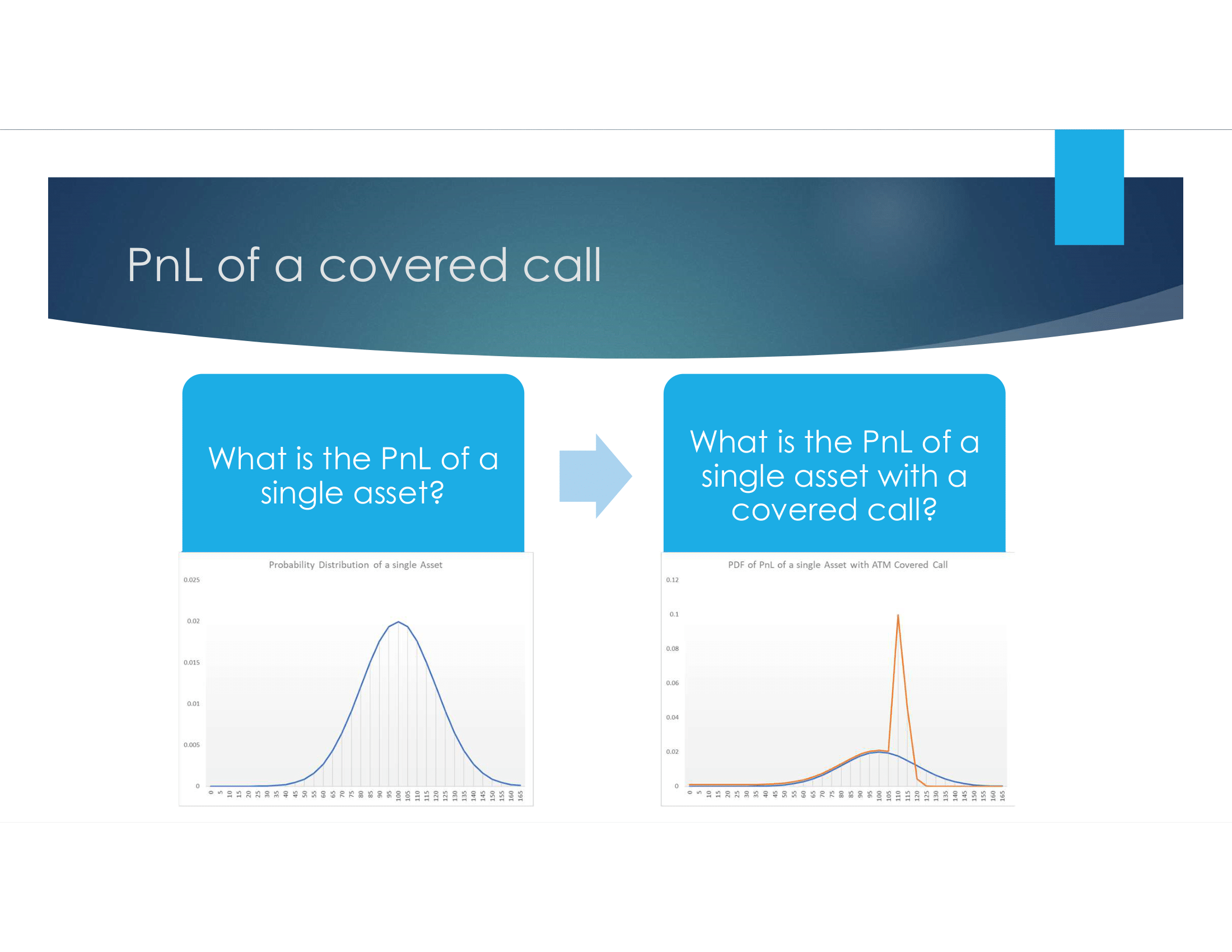

PORTFOLIO SIMULATOR

Monte Carlo Simulator to Analyse Risk and Return Scenarios for Portfolios including derivatives

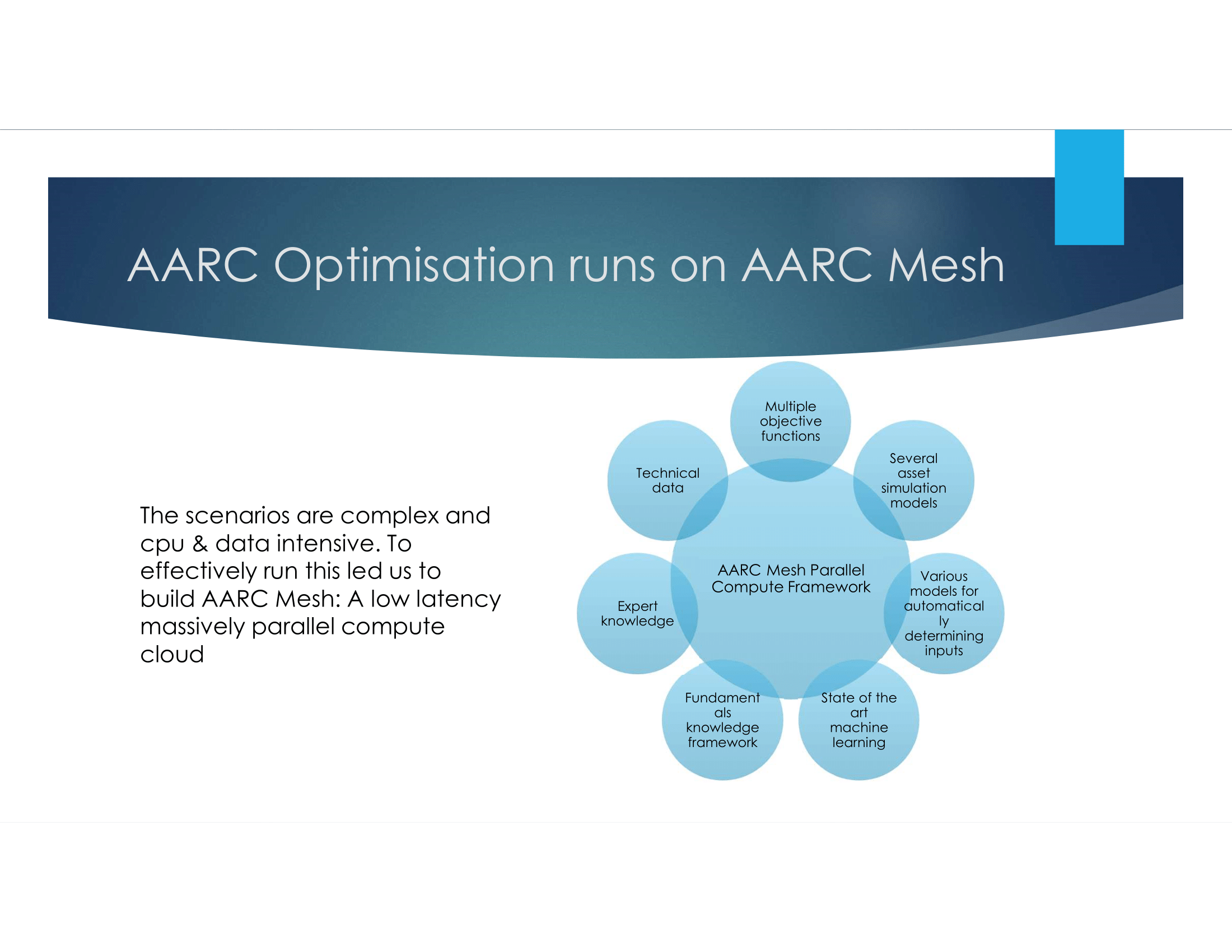

PORTFOLIO OPTIMISER

Optimise an equities portfolio for return vs risk

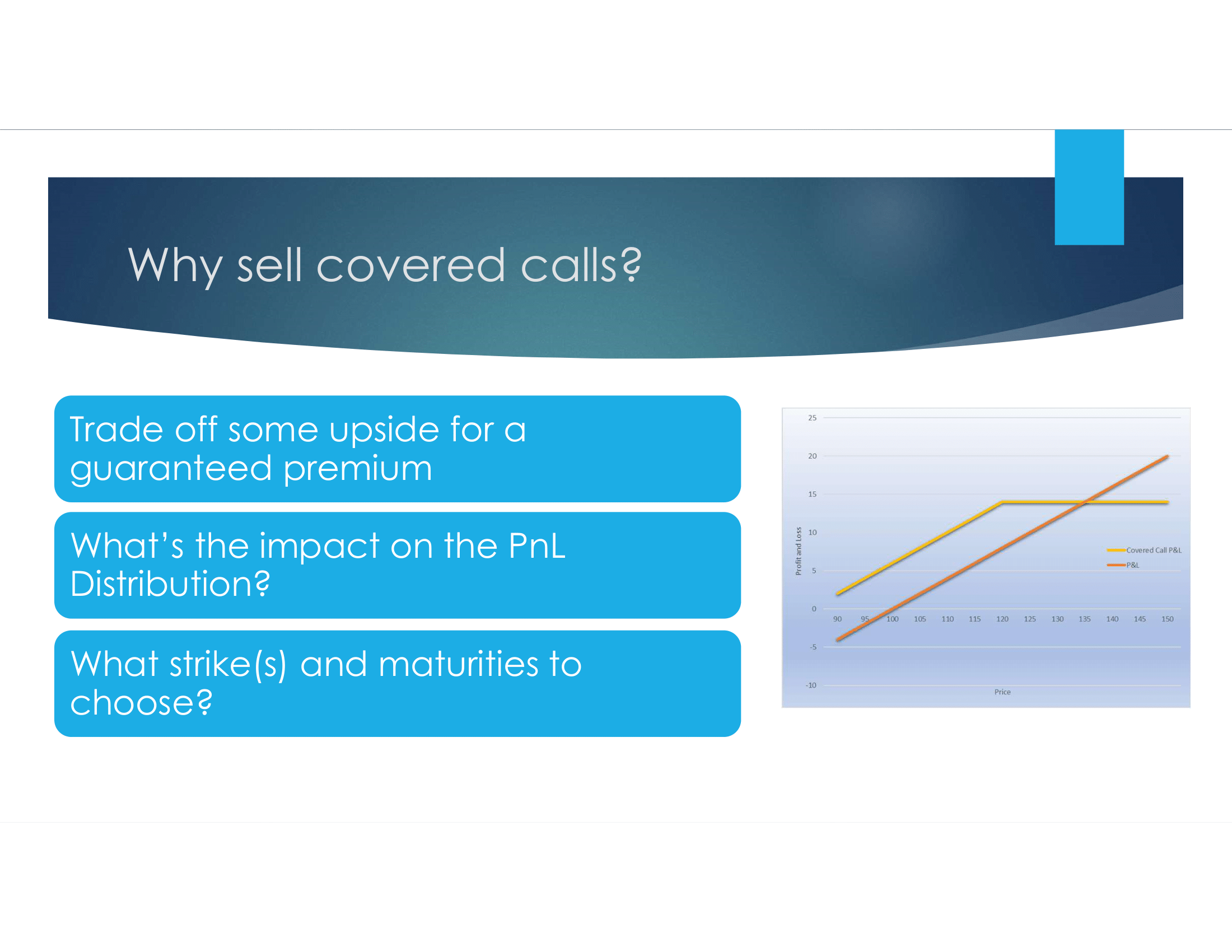

COVERED CALL ANALYSER

Find and analyse the best risk/return compromise